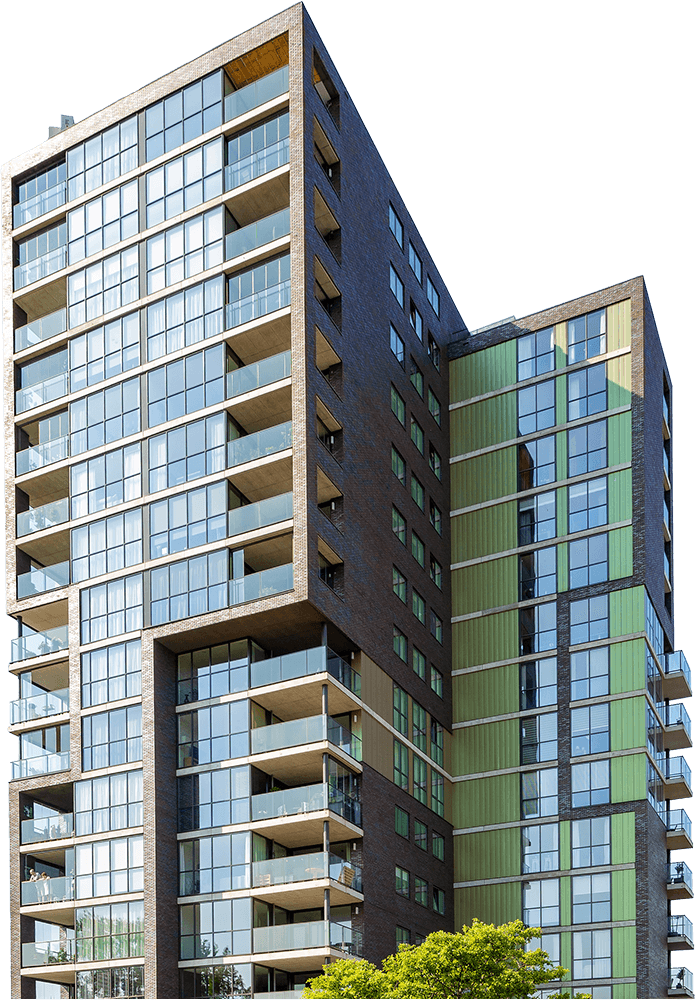

Residential

Rental homes in the mid-price range are currently in demand. These properties play a key role in the Dutch housing market. Affordable and sustainable homes in the right location are essential to a thriving housing market. Altera’s mission is to contribute in significant and meaningful ways to ensuring the availability of these types of homes.

Retail

Retail can play an important role in society, especially when they are located in residential areas. Neighbourhood shopping centres and supermarkets are great for everyday grocery shopping but they also serve a clear social purpose. Good retail investments meet current demands and boost local quality of life in neighbourhoods. Reason for Altera to focus on finding the right place for the right retail format.